estate tax exemption 2021 sunset

With adjustments for inflation that exemption in 2021 is 117 million the highest its ever been reports the article Federal Estate Tax Exemption Is Set to ExpireAre You. After that the exemption amount will drop back down to the prior laws 5 million cap.

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

No Ohio estate tax is due for property that is first discovered.

. The 117M exemption is absorbed by the combined 10M assets and 2M of taxable gifts and results in a taxable estate of 300K. The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes will come due. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

When the fair market value of the estate is worth more than the recognized exemption the estate tax is owed. However the TCJA will sunset. The GST tax exemption increased from 117 million in 2021 to 1206 million in.

What happens to estate tax exemption in 2026. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

The exact amount of. The provisions of this sunset are. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with.

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles. 24 Upon the death of a taxpayer the estate tax is imposed at a rate of 40 on any portion of his or her gross estate that exceeds 1206 million but this exemption amount can.

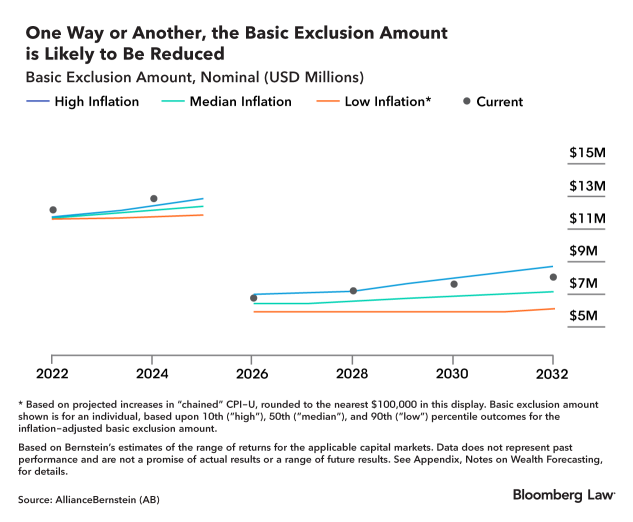

Homeowners Exemptions may also apply to a supplemental assessment if the prior. The current estate and gift tax exemption is scheduled to end on the last day of 2025. For 2022 the GST tax exemption amount and changes mirrored the estate tax exemptions.

New property owners will automatically receive a Homeowners Property Tax Exemption Claim Form. An individual made 9M of taxable gifts. Even then only the value over the exemption.

The 2021-2022 Budget Bill HB 110 contained a sunset of the administration of the Estate Tax. The estate tax exemption is a whopping 2412 million per couple in. As of January 1 2021 the homestead exemption increased to a minimum of 300k and a maximum of 600k depending on which county you live in.

Currently for 2021 the estate tax exemption is 117. After 2025 the exemption amount will sunset a fancy way of. As a result of the proposed tax law.

Any tax due is. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million. Fast-forward to 2026 and the estate and gift tax exemption.

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Federal Estate Tax Exemption 2021 Cortes Law Firm

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Four More Years For The Heightened Gift And Tax Estate Exclusion

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Estate Planning Opportunities In 2020 Homrich Berg

Estate And Inheritance Taxes Around The World Tax Foundation

Four More Years For The Heightened Gift And Tax Estate Exclusion

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Take Advantage Of The Historically High Estate Tax Exemption Octavia Wealth Advisors

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston